Alternative Housing Solutions for Zillennials: From Co-Living to Tiny Homes

As the housing market continues to heat up and homeownership becomes increasingly elusive, Zillennials—those born roughly between the late 1990s and early 2010s—are feeling the brunt of this economic squeeze. But what does this mean for them, and what are the broader implications? Let’s delve into the challenges faced by Zillennials and explore what it means for their future.

The Housing Market Crisis

The rising costs of real estate have been a persistent issue, but for Zillennials, it’s becoming a crisis. With skyrocketing home prices and inflation driving up living costs, many in this generation find themselves priced out of the market. Factors contributing to this include:

Skyrocketing Home Prices: The cost of homes has increased significantly over the past decade, outpacing wage growth and making it difficult for many Zillennials to save for a down payment.

Student Loan Debt: High levels of student loan debt are diverting potential homebuyers’ savings away from down payments and towards loan repayments.

Income Stagnation: While the cost of living and housing has risen, wages have not kept pace, leaving many Zillennials struggling to keep up.

Shifting Priorities and Lifestyle Changes

The traditional dream of homeownership may no longer be as appealing or attainable for many Zillennials. As a result, their priorities and lifestyles are shifting in response:

Renting as a Long-Term Option: Many Zillennials are opting for long-term renting rather than buying. Renting provides flexibility and avoids the financial strain of homeownership.

Embracing Minimalism: With the high cost of living, there’s a growing trend towards minimalism and smaller living spaces, allowing Zillennials to focus on experiences rather than material possessions.

Prioritizing Experiences Over Ownership: Zillennials are increasingly valuing travel, experiences, and personal development over traditional markers of success like owning a home.

The Rise of Alternative Housing Solutions

In response to the housing crisis, new and innovative housing solutions are emerging, catering to the needs of Zillennials:

Co-Living Spaces: Shared housing arrangements offer an affordable alternative to traditional homeownership and can foster a sense of community.

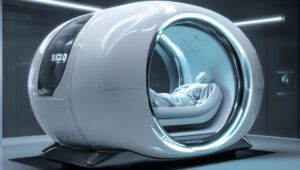

Tiny Homes: The tiny home movement provides a more affordable and sustainable living option that aligns with minimalist values.

Modular and Prefabricated Homes: These homes offer a more cost-effective and customizable option for those who want to own but are priced out of traditional real estate.

Economic and Social Implications

The inability of Zillennials to buy homes has broader economic and social implications:

Impact on the Housing Market: A significant portion of the potential homebuying market is missing, which could lead to shifts in market dynamics and new opportunities for developers and investors.

Changes in Community Dynamics: As more people rent rather than own, communities may become more transient, potentially affecting local engagement and long-term relationships.

Financial Security and Wealth Accumulation: Homeownership has traditionally been a key method of building wealth. With Zillennials struggling to enter the market, there may be long-term implications for wealth accumulation and financial security.

Moving Forward: Embracing Change

While the challenges are significant, Zillennials are demonstrating resilience and adaptability. Embracing new housing solutions and shifting priorities can lead to a redefined version of the American Dream. It’s a reminder that success and stability can be achieved through various paths, and the traditional notions of homeownership are evolving to reflect the changing times.

By understanding and addressing these shifts, both individuals and policymakers can work towards creating a more inclusive and adaptable housing market for future generations.